Serving as the backbone of the biopharma industry, the clinical trials market is expected to reach a value of USD 84.43 billion by 2030 according to Precedence Research. The Biotechgate database lists over 780,000 trials and is continuously updated with new information for trials covering both well-known areas like oncology as well as orphan diseases targeted by innovative technologies. In this article, you will find an overview of the latest trends that have emerged amidst the information in our database.

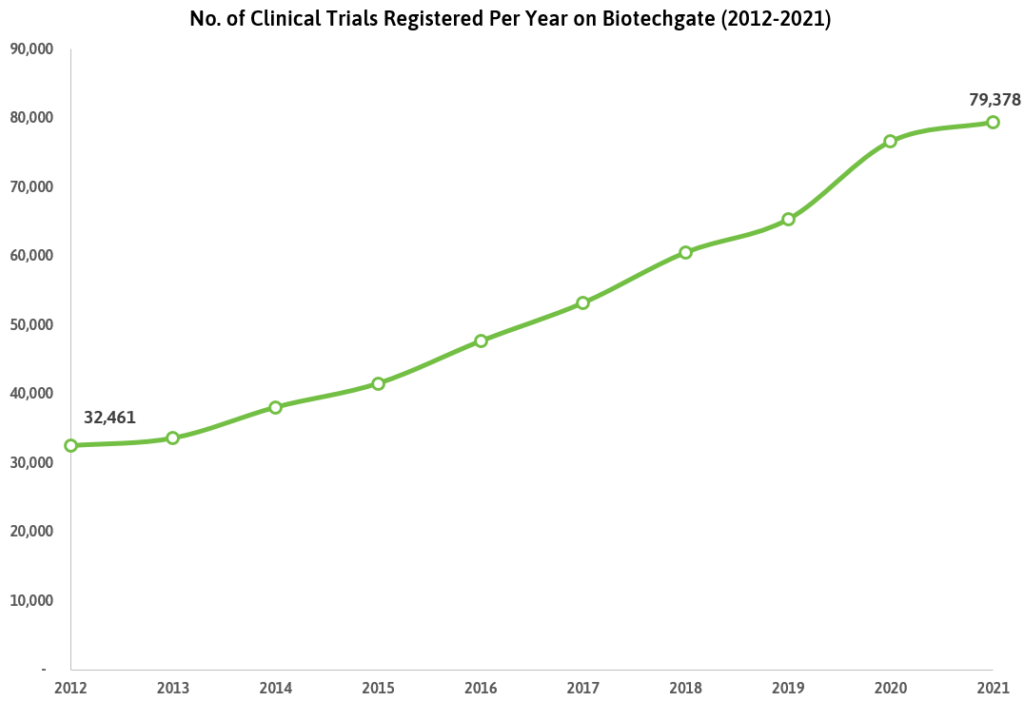

Clinical Trials in the Last Decade

Between 2012 and 2021, the number of registered clinical trials increased by 145%, with the growth rate slowing slightly in 2020 due to the impact of COVID-19. The pandemic led to many trials being paused, research staff being reassigned to COVID-related activities, and patient enrollment declining significantly, according to a 2022 study.

Trials by Source Register

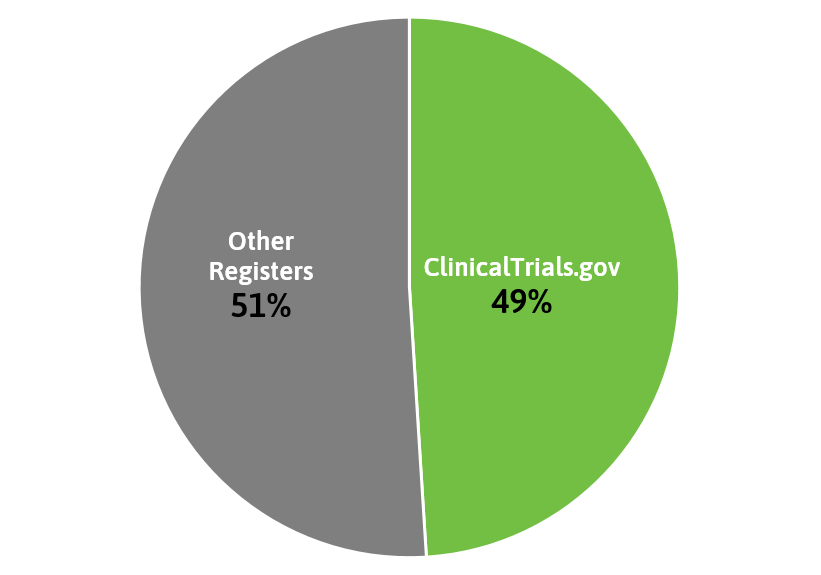

Clinical trial data on Biotechgate is obtained from a variety of source registers. Between 2018 and 2022, the registers with the highest number of recorded trials were:

- ClinicalTrials.gov

- Chinese Clinical Trial Registry (ChiCTR)

- Clinical Trials Registry India (CTRI)

- UMIN Clinical Trials Registry (UMIN-CTR)

- EU Clinical Trials Registry

Collectively, these registries accounted for almost 85% of trials registered in that time period, with ClinicalTrials.gov making up almost half of the studies.

This is not necessarily indicative of the number of trials being performed in the source register’s regions, as there has been a widespread issue in the clinical trials space where they are not being officially recorded, with one study finding a total of 27% of trials going unregistered. Legislation has been enacted in many countries to try and curb this. The European Union implemented Clinical Trials Regulation in January 2022 to centralize trial entries into a single portal, with penalties being enacted by each member state for organizations that fail to register their trial.

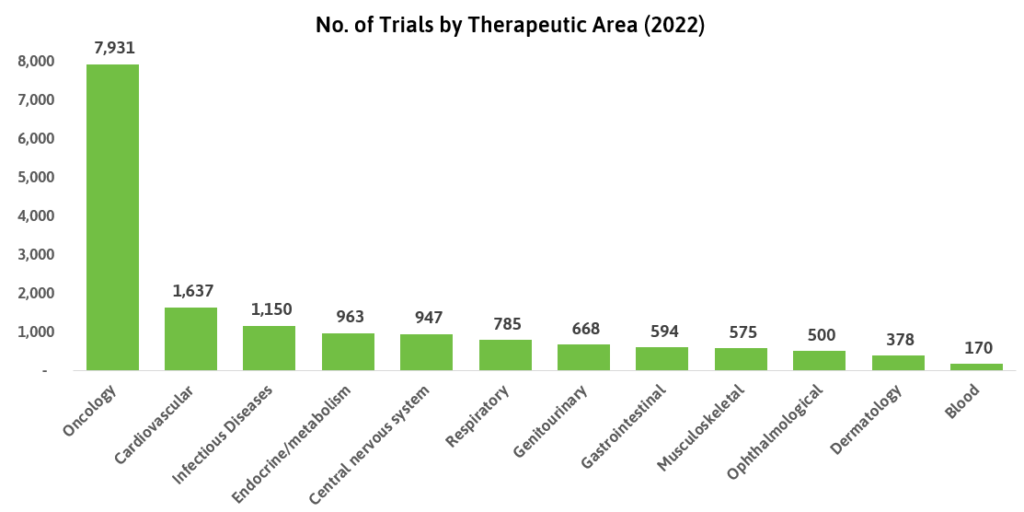

Most Popular Therapeutic Areas

Oncology remains the dominant therapeutic area in clinical trial research, with almost five times more trials recorded on Biotechgate in 2022 compared to cardiology, the second-highest. Blood-related treatments such as hematology and immunology saw the least number of trials recorded. Conversely, this field has the highest per-patient costs according to Statista, with a median of USD 310,975 per patient compared to an average of USD 41,413.

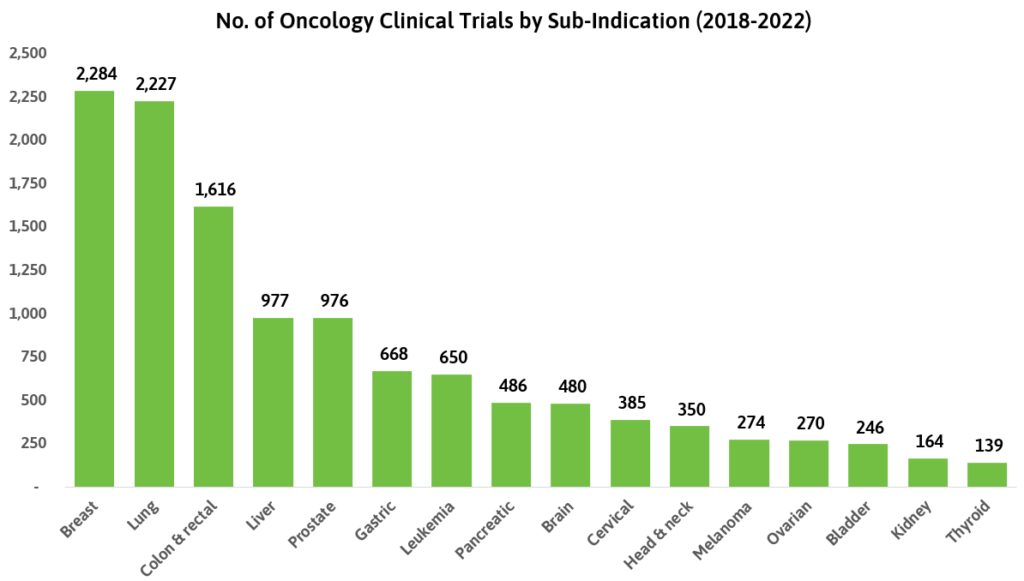

A Closer Look at Oncology

While oncology stands as the area with the most clinical trials, the sub-indications within it are quite varied. Between 2018 and 2022, trials targeting the treatment of breast and lung-related cancers were the most registered. Incidentally, these are cited as the most common cancer types by the National Cancer Institute.

In conclusion, the clinical trials market continues to thrive, with the number of registered trials increasing year after year. Efforts to decrease the number of unregistered trials have played a role in this growth. The sector is evolving as a result of the integration of new technologies and will continue to drive innovation in the biopharma industry.