Biotech companies are always on the lookout for additional cash given the R&D-focused spend of the industry. Amid a downtrend in the market, private equity and IPOs may not be considered as attractive of an option compared to two years ago, or even last year. One finance alternative that is re-emerging is debt financing, as companies endeavor to continue their R&D and commercialization efforts.

The usage of debt financing

Traditionally reserved for a small amount of companies, debt financing is now being increasingly utilized by companies in a variety of stage of their life cycle. Specifically, mature companies have used this instrument with high debts amounts in an effort to extend their cash runways that have been deteriorating from a COVID-influenced boom period. Debt financing can offer benefits to an organization compared to other financing types. One of the attractions to this is that it is non-dilutive, so companies don’t have to sacrifice any of their equity.

Trends according to Biotechgate

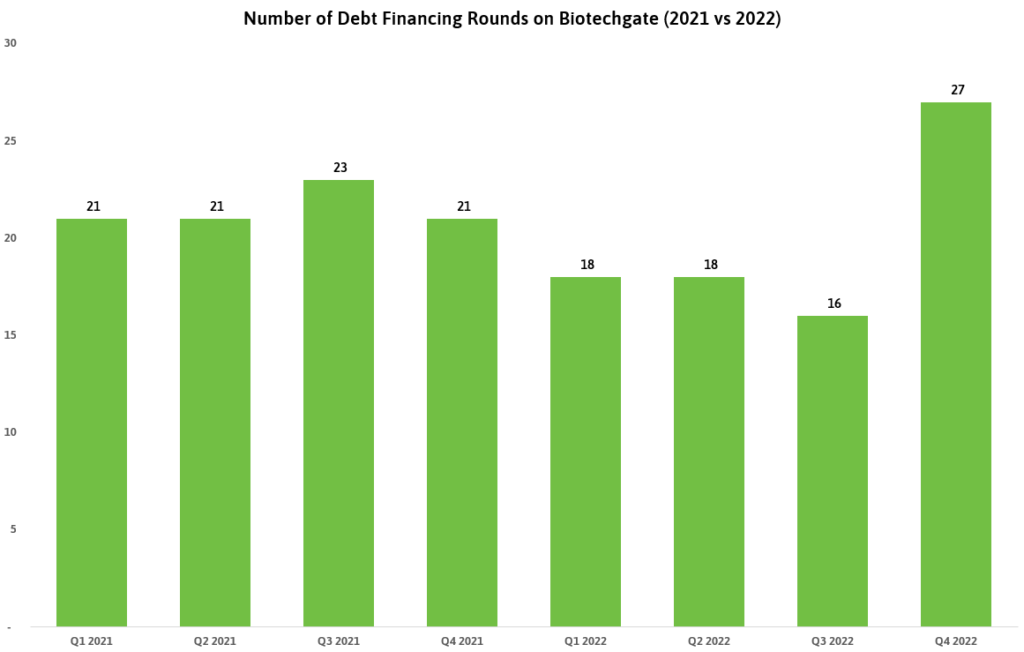

The last quarter of 2022 saw a marked increase in the number of debt financing rounds on Biotechgate, with the figure increasing from 16 rounds in Q3 to 27 in Q4 – a 67% rise. Key deals in this quarter include Verona Pharma securing up to USD 150m in debt financing in order to give themselves an extra three years of runway for the commercial launch of one of their assets in the US market.

This trend appears to have carried over to the New Year, with January 2023 also experiencing larger usages of debt financing, closing with 10 rounds taking place compared to just 5 in January 2022. This includes a USD 400m loan for Caris Life Sciences in January 2023.

What’s ahead?

So what’s next for debt financing for biotechs? Current data highlights an increase in its utilization as companies try to find ways to protect themselves amid a time when the industry is currently experiencing some headwinds through a combination of geopolitical uncertainty, rising interest rates and inflation. While financing through debt can certainly be beneficial to organizations, it’s well-known that biotechnology is, by nature, a risky industry. If a company’s pipeline ends up in failure whether it’s through R&D or its commercial success, their inability to repay loans may ultimately lead to their insolvency, such was – as an example – the case of Synergy Pharma in 2018 after their lender refused to renegotiate the lending terms involved in a USD 300m loan. Thus, we see debt financing for biotechs still as a niche form of financing, interesting for more mature, close to revenue generating companies. Also, the increase in interest rates will make this financing instrument more costly for the companies.