The global pandemic generated record investments in life science companies back in 2020 and 2021, when growth was largely driven by development of COVID-19 vaccines and drugs that helped overcome the acute phase of the pandemic. However, in 2022 the war in Ukraine has led to macroeconomic changes that causes the financial environment for the global biopharma industry to shift. In light of these recent developments, it is worth taking a closer look at the financing state of the biotech and pharma industry by comparing popular therapeutic areas: What are the areas that received the most financing rounds and investment value during this time? How has their financing state changed and which trends have emerged in the process?

The most popular therapeutic areas: Oncology on top

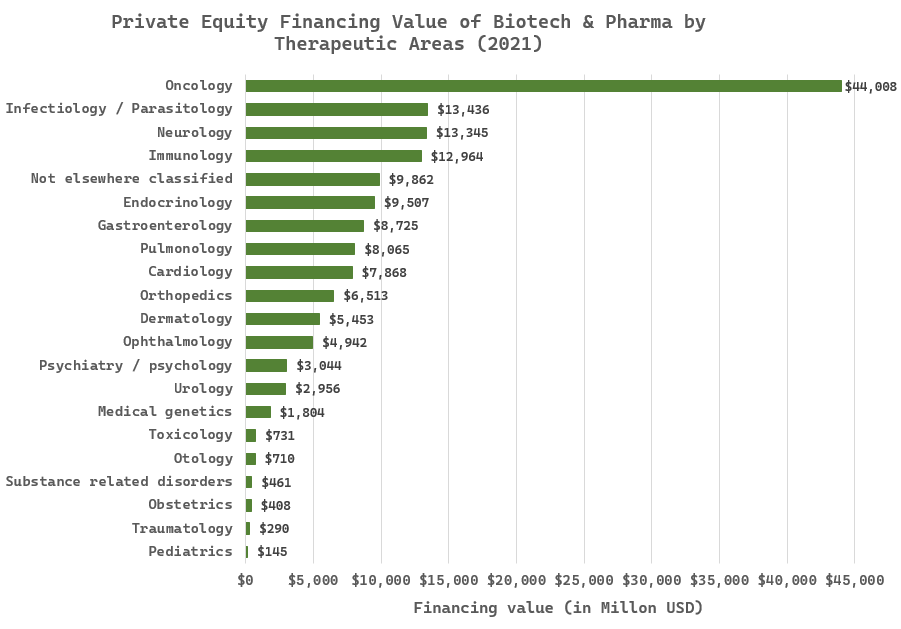

Figure 1 compares the private equity financing value of biotech and pharma companies by therapeutic areas in 2021. As Biotechgate data shows, oncology is by far the most popular therapeutic area in the biopharma venture ecosystem. It is the therapeutic area that received the most private equity financing rounds in the US, Europe and rest of world last year. Impressively, Oncology received a total private equity financing value more than three times as high than that of infectiology / parasitology, which came in second on the global scale of the biopharma sphere, followed by neurology, immunology, and therapeutic areas not elsewhere classified.

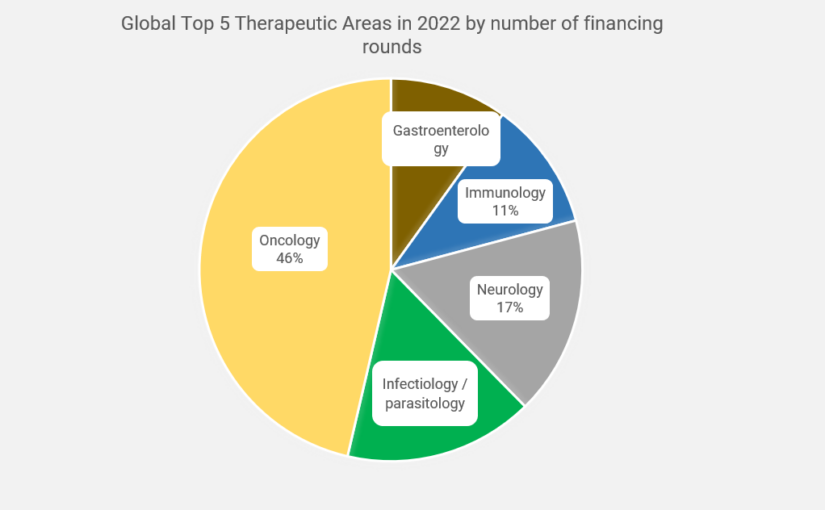

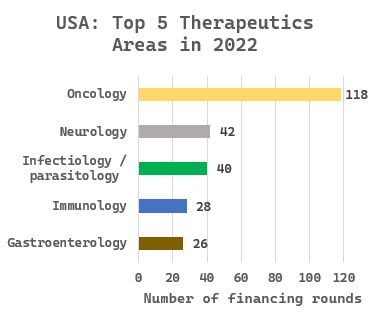

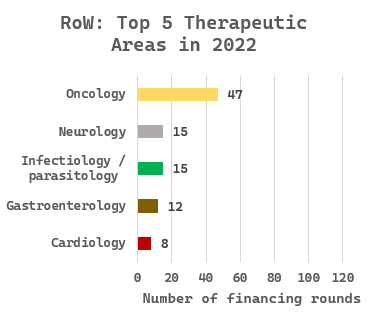

As covered in a previous article in August 2021, oncology has also long been the most popular therapeutic area for clinical trials. The annual Biotechgate life science trend analyses that were created in cooperation with Biotechgate’s regional collaboration partners show how oncology assets dominate the total number of biotech assets of different countries all over the world. When comparing the top 5 therapeutic areas in 2022 in the US, Europe and rest of the world by looking at the number of private and public financing rounds, oncology is always on top, neurology in second, closely followed by infectiology in third place, while the remaining two top therapeutic areas alternate depending on the region. For Europe, immunology and cardiology hold the fourth and fifth place, for USA it is gastroenterology and immunology and for the rest of world gastroenterology and cardiology, respectively (figures 2 – 4).

Oncology: Financing Highlights

One of the currently most promising approaches for cancer treatment are cell therapies. An exceptionally big private equity round for a cancer cell therapy company this year was raised by Affini-T Therapeutics, Inc. in March with a deal amounting to USD 175m. The US-based biotechnology company is developing a cell therapy platform to target mutations causing solid tumors by optimizing the function of T-cells. The round was co-led by Vida Ventures and an investment unit of Bayer. With the funds, Affini-T plans to drive multiple oncogene driver programs into clinical trials.

A more recent example of an oncology company receiving a large investment is Tessa Therapeutics Pte Ltd., a company based in Singapore which is seeking to treat hematological cancers and solid tumors with cell therapy. Tessa raised a private equity Series A deal of USD 126m in June, led by Polaris Partners, to advance the clinical development of their two key CAR-T-therapy programs, one of which is currently in phase II/III.

Impact of geopolitical events on therapeutics financing

After the rapid growth fueled by the pandemic, venture capital investments reached their peak in 2021 when a majority of COVID-19 restrictions were lifted. In 2022, the life sciences industry faces new challenges due to an uncertain global business landscape, first and foremost caused by the war in Ukraine. The macroeconomic effects are evident in almost all sectors. Still, early-stage drug development companies are subject to a particularly high risk, given they are hardly ever profitable at this stage and have cost- and time-intensive clinical trials ahead.

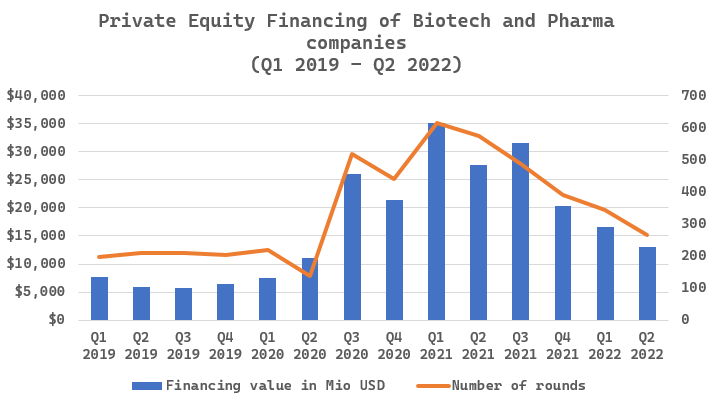

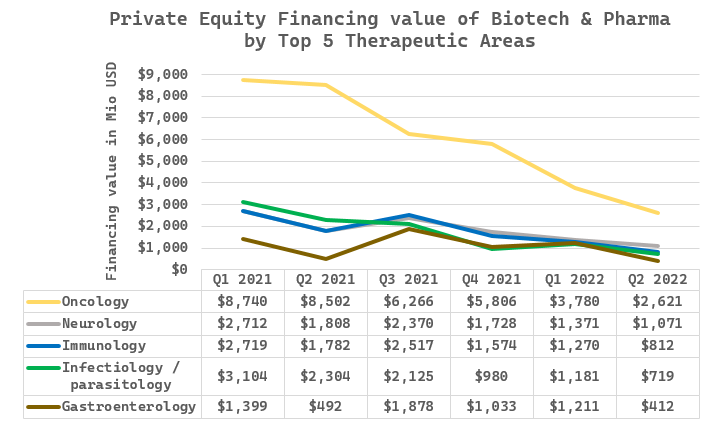

Across all therapeutic areas, biopharma companies have been hit hard by the recent uncertainty in the market. For example, private equity rounds of biotech and pharma companies developing cancer drugs declined by 70% from Q1 2021 to Q2 2022 (figure 5).

In contrast to the biotech boom the pandemic caused, the media are now talking about a “downward spiral”, “funding cliff” or “funding Sahara”. The increase in interest rates and growing inflation as well as disruptions in the supply chain are reinforcing this trend.

The good news is that the overall biopharma financing volume is still at a relatively high level compared to the pre-pandemic state, despite the challenging conditions on the market (see figure 6). See in next month’s newsletter how these effects are translating into the public market and what this means for biotech start-ups and M&A activity.

Read more about latest financing activities in the monthly biotech financing summary, provided by Venture Valuation.