Are you looking for investors? Finding investors and raising capital is one of the most challenging tasks you will face in business, especially if it’s your first time. It is crucial to be realistic about costs and timelines so you can find the best investor to enhance your company growth.

Overall, from start to finish, it can easily take 9-18 months to raise capital for the first time. Also, all the related costs for travel, hotel accommodations, conferences, and legal expenses can easily accumulate into substantial amounts. It is imperative that you have a realistic plan of how much you are looking to raise as well as a solid, interesting story for potential investors. It is likely that the investor you are talking to is already very knowledgeable in their areas of interest, so focus on a simple, attractive pitch to capture their interest in the short amount of time you have in front of them. This should also be reflected in your business plan as well as on your website – keep it straight to the point.

To save yourself time and money, a variety of tools are available to streamline the search and make it more efficient and therefore more cost-effective. Biotechgate, as an example, provides a unique Investor Database where companies who are looking to raise money can identify relevant investors within their specialist sector, therapeutic area or phase. Companies can then generate a list of potential investors who have given us direct information regarding their current allocations and areas of interest. For most investors there is even a point of contact available that can help as a “door opener” when contacting an investor for the first time.

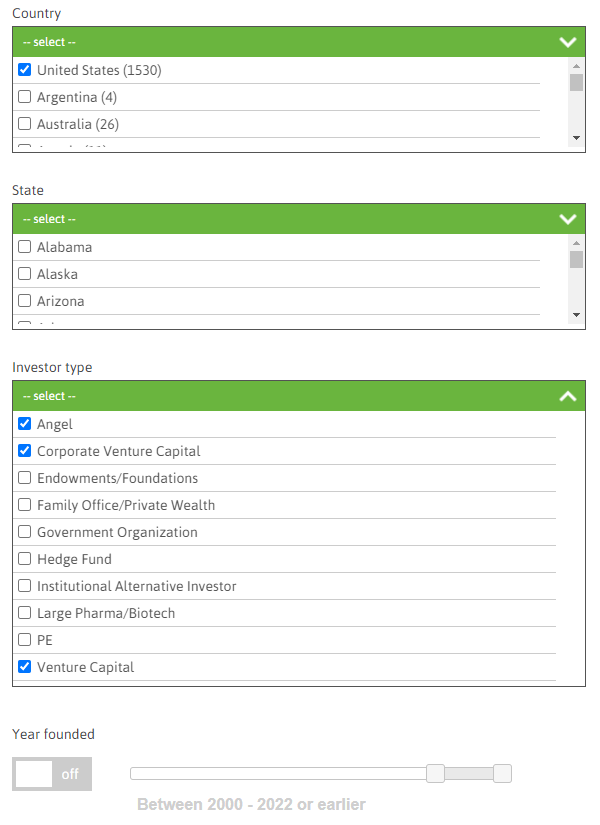

Finding investors in the database is simple, with a range of criteria available. These include the country, investor type and the year of their foundation as shown below.

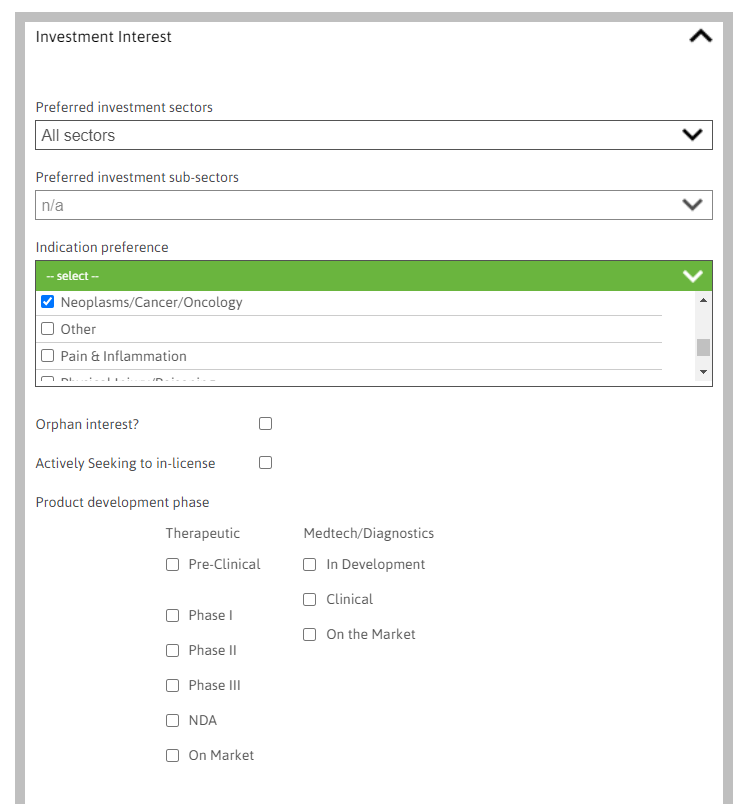

Especially interesting for the investor search is the ‘Investment interest’ section where you can select the filters that are most relevant to your organization’s activities. This includes the investor’s preference regarding the preferred investment sector and indication preference, the geographic exposure and the company ownership – such as a public or private organization.

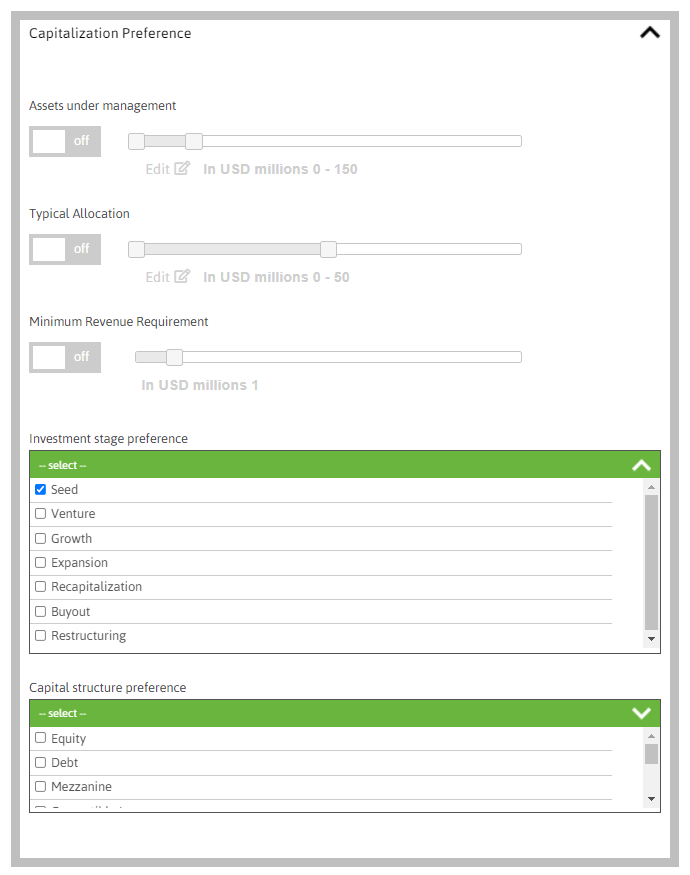

Lastly, as seen below, there is the ‘Capitalization preference’ section. Here, you can select filters like the investor’s current assets under management, the investment stage preference and the preferred capital structure.

When you have chosen your criteria, click ‘Search’ to be brought to your results. If you have received too few or too many results then you can refine your search. You also have the ability to download the results as an Excel file for later viewing.

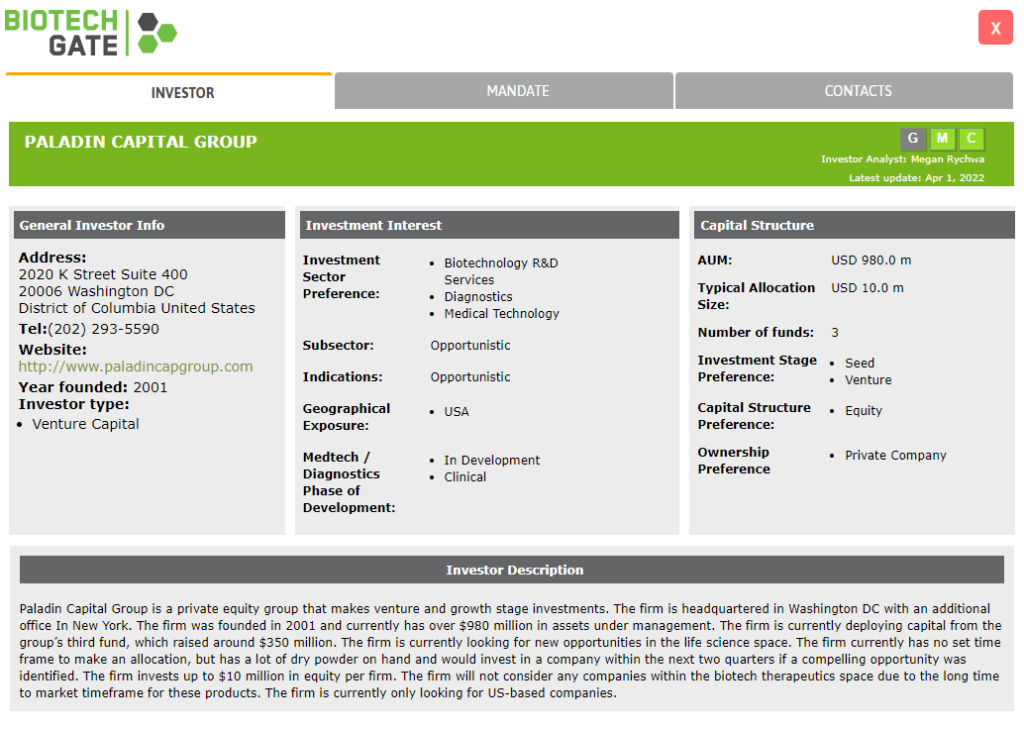

Once you click on a profile you will be shown an overview of the investor. This includes general company information, their investment interest and the capital structure of the organization. Profiles also include the investor mandate which gives you a further insight into what kind of company the investor is seeking. Finally, you also have access to contact information where you can get in touch with the relevant company representatives if you wish to put your organization forward as a candidate for investment.

If you want to learn more, watch our video covering our Investor Database: