Staying up-to-date on who your competitors are and their recent developments should be a crucial aspect of your business strategy to maintain a competitive advantage and avoid losing potential market share. You may also be part of a new company, entering an industry where you require an insight into the competitive landscape first. Nevertheless, it can be overwhelming when faced with what aspects you need to track. Here, we will give you an overview of what is important to look at when starting your competitive intelligence process.

The Competitive Intelligence Process

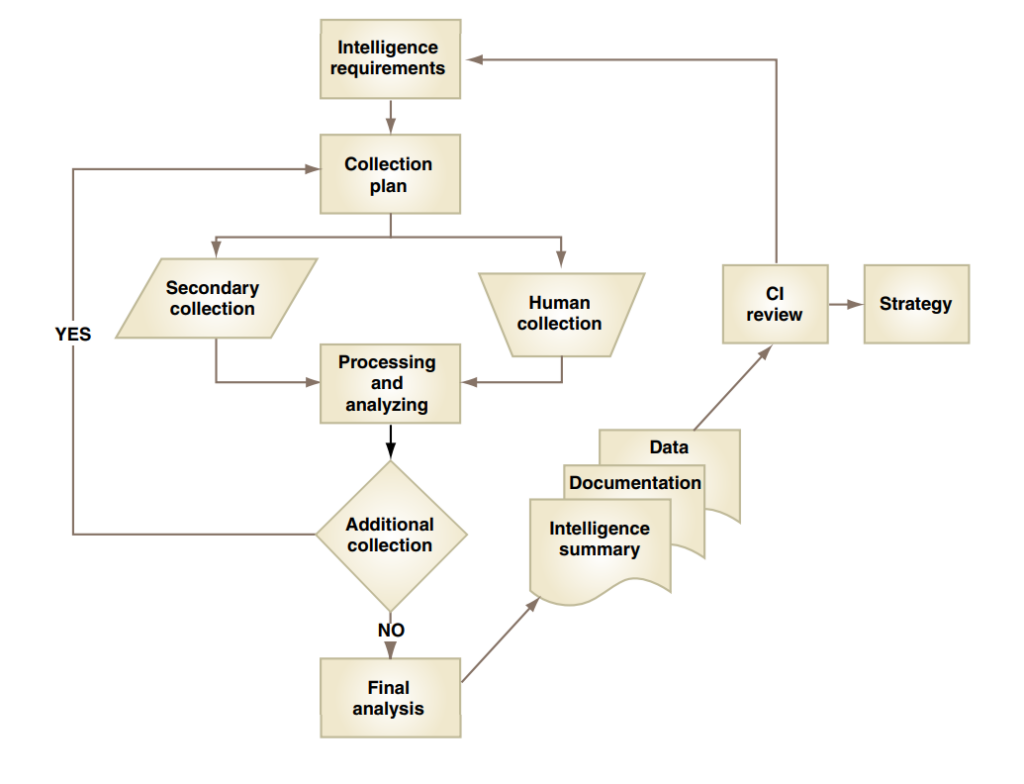

For your competitive intelligence process to be successful, you must identify what you need to know from the chosen competitor. Following this, a collection plan needs to be put into place, ideally with a mixture of primary and secondary data such as company filings and databases. Once you have gathered your required information, it must then be processed and analyzed before the relevant data is finally condensed into a report that is aligned with your business strategy.

What Should You Monitor?

Intellectual Property, Clinical Trials & Drug Development

For companies directly involved in asset development, these products serve as the backbone of their organization’s viability and income. Most of the time, they are the primary source of competitive advantage and so must be monitored closely. As a result, part of your competitive intelligence activity should be focused on monitoring your competitor’s pipeline for updates on current or new drug candidates.

Other options include looking into newly-published journal articles centered on your competitor’s studies. While for IP, the most common and straightforward way to monitor this is to keep track of patent applications in your relevant region.

Partnerships

Partnerships and collaboration are becoming increasingly ubiquitous within the industry, where big pharma companies serve as more of a platform to scale operations for smaller biotechs as well as helping to spread costs. A greater number of collaborations between companies and government agencies as well as universities has also been noted. Monitoring your competition’s existing and new partnerships can give you an insight into how they are performing and what markets they may be expanding into.

A common way to discover the details of partnerships is by reading the contractual agreement between both parties. These are made publicly available for exchange-listed companies through organizations such as the SEC.

Governmental Approvals

With biotech and pharma organizations being notoriously difficult to turn a profit, there are only a small handful of indicators that signal a transition towards sustainable revenue. This catalyst is governmental approval – represented by the FDA in the US and the EMA in the European Union. For the year 2020, 50 new drugs had been approved by the FDA. While this figure is very gradually increasing year after year, it can spell success or doom for the firm involved depending on the outcome, with the success rate from Phase I to FDA approval being identified by BIO as 9%.

Since it can be such a fulcrum point for companies after years of R&D, it is vital to keep an eye on this. Approvals by the FDA and EMA can be tracked on their websites, with most other countries having their own equivalent agencies.

New Companies

On top of monitoring existing competitors, new entrants are always a possibility. While the threat of new entrants can be considered rather low in the industry due to the costs involved, it’s not outside the realm of possibility for larger companies to establish new divisions, along with start-ups spun out by universities or backed by investors.

Emerging competitors can be identified by monitoring clinical trials through individual country’s registries, or by accessing them in one place on Biotechgate. Another way to identify growing competitors is by viewing financing rounds to observe if there are any recent significant investments into organizations. You can also pay attention to research conferences taking place, where preclinical data could be announced.

Other Methods

Competitive intelligence must be implemented as an ongoing process instead of a one-off task, where you must be almost hyper-aware of the competitive landscape. Crucial changes can happen by the day, such as a company abandoning an asset, partnering with another organization, or gaining approval for a particular drug. This can be aided by watching out for company press releases, investor presentations or even creating a dedicated alert on websites such as Google News. Overall, the data and intelligence gathered must be then turned into meaningful insights that your organization can develop upon.