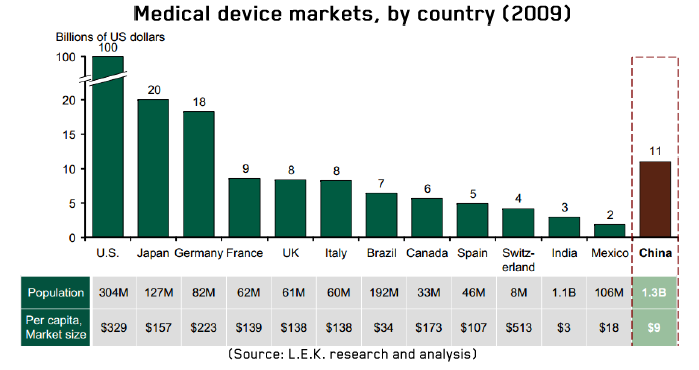

China`s medical device market is the fourth-largest in the world, estimated to be USD 11bn in 20091. However, medical device per capita expenditure is still very low and the Chinese medical device market is one of the fastest growing markets in the world. In the course of this year, Venture Valuation will endeavor to provide you with important facts, figures and background information about China to help you understand this developing and interesting market.

For the period of 2012-2017, analysts estimate an annual growth of 20% for the Chinese medical device market2. The major growth drivers of China`s medtech market are: 1) fast economic growth (9% annual GDP growth over the past 20 years2); 2) rapidly increasing disposable income; 3) government investment in healthcare spending (more than USD 120 billion was committed to upgrade the healthcare system from 2009-20112); 4) large aging population.

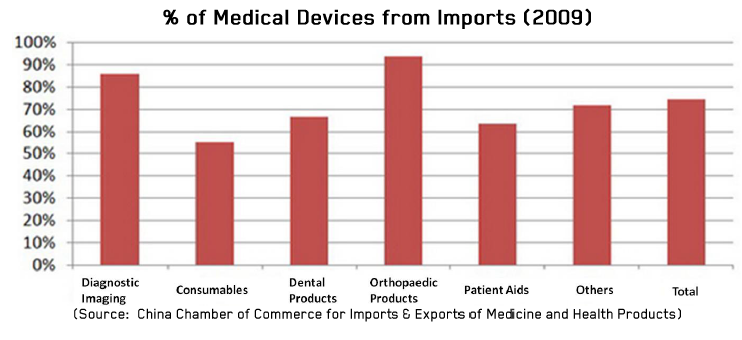

China`s medical device market is highly dependent on imports, with the major suppliers being the US, Japan and Germany. Imported medical devices contribute to 74% of the Chinese medical device market. Sectors that depend most heavily on imported products are high-tech medical device sectors, such as diagnostic imaging and orthopaedic products (85% and 93%, respectively)3.

A number of challenges exist for companies wishing to enter the Chinese market, for example:

- Credibility of distributors. Some distributors may not understand or offer non-compete agreements. Some others do not have the capital or commitment to stay in business over an extended period of time.

- Highly fragmented distribution networks in China. There are more than 150,000 medical device distributors in China, and they typically specialize in a region rather than on a clinical focus4.

The easiest approach to capitalize on the market opportunities present in China is to partner with a credible Chinese company with already established distribution networks and successful distribution records, thus leveraging their success.

Examples of Chinese distributors of medical devices (Source: biotechgate.com)

NeuvoMedica http://www.neuvomedica.com

Sino-pharma http://www.sino-pharm.com

Cemma Medical http://www.caring-company.com

NEW: Venture Valuation offers the following Chinese focused services:

Partner searching:

Find your ideal Chinese partner in the same therapeutic fields, leveraging the partner’s distribution success for your products.

Credibility check/due diligence:

Our partner in China has local expertise for credibility checks and due diligence on your candidate partners before you engage in any partnership.

Market overview:

In our global Biotechgate database, we have over 700 credible Chinese companies listed with categorization, contact details and English company descriptions. With a subscription to biotechgate, you get access to a growing China database and also to a global database with over 29’000 companies.

Contact us for any enquires you have concerning entry into the Chinese market:

Dr. Jingwen Shi, Zurich, Project Manager China, +41 43 321 8660, j.shi@venturevaluation.com

Dr. Patrik Frei, Zurich, CEO, +41 43 321 8660, p.frei@venturevaluation.com

List of sources:

- Carol Wingard, Helen Chen. The China medical devices market: opportunities and growth challenges. L.E.K. Consulting, 2011.

- China medical device Intelligence report. Espicom, 2013.

- China Chamber of Commerce for Imports & Exports of Medicine and Health Products, 2009.

- TCT Medical offers a new model for device distribution in China. Medical devices today, 2010.

Click here to download Venture Valuation’s China Focus